News

Your budget ‘s the number you earn prequalified to own regarding bank. You should look at so it count to acquire a stronger insights of how much household you might reasonably (and you may easily) pay money for.

You have made pre-recognized to possess home financing after you get a hold of your ideal family. Possible come back to the bank for the number need, and they’ll sometimes accept your into financing or deny you. We wish to rating pre-accepted showing you to definitely, in case the offer are accepted, you are completely with the capacity of purchasing the house.

Imagine if We have a reduced credit history and you can financial institutions wouldn’t provide in my opinion?

Your credit rating can be to 740 or maybe more getting banking institutions provide a respectable mortgage. Whether your credit rating is just too lowest and you can banks try flipping you away, you will find some actions you can take.

1. Look into an enthusiastic FHA mortgage. FHA fund are especially if you have lowest credit scores. You could potentially get a keen FHA financing if you make yes to analyze the newest caveats in the above list. A keen FHA loan is a good selection for you.

2. Your credit score need not feel reduced permanently! You could raise they. Make an effort to lower financial obligation you commonly thought to be an excellent risk to make your entire charge card repayments after they are due. Cannot has actually a balance on the credit card if you might move it.

Banking institutions select credit card repayments once the a try work with for your mortgage. The greater amount of responsible you are together with your charge card, the greater responsible you’ll end up with your home loan. (Banking institutions state this. We realize just how responsible you are currently.)

Set-up a keen autopay element for those who just forget to pay out-of your cards, but be mindful of it. Sometimes, autopay takes one to complete period when deciding to take feeling when you begin it, and you you certainly will run into almost every other unforeseen technical difficulties.

So what does Bristol loans they mean if someone co-cues the loan mortgage with me?

When you have difficulties bringing financing, you could have somebody co-sign the mortgage to you. Your co-signer takes full obligations throughout the loan when the you don’t pay. This new co-signer is actually on the name of the home.

Manage mortgage loans keeps desire?

Sure, you’ll have to spend interest on your mortgage. You’ll want to secure a minimal rate you could potentially.

What are current home loan cost?

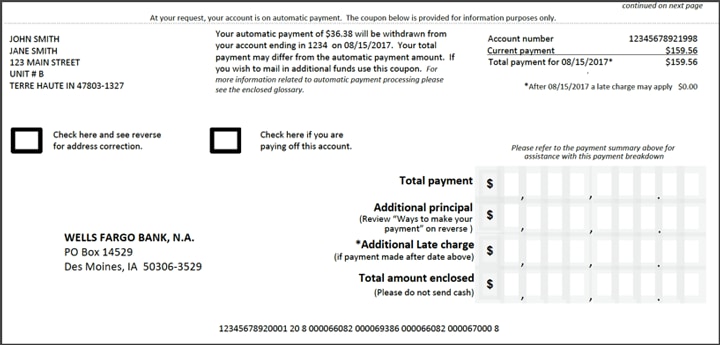

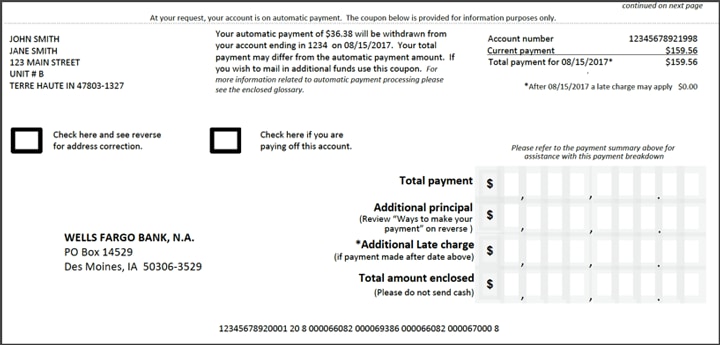

There are many different useful websites that will let you know exactly what newest home mortgage cost is. Internet sites such as Bankrate and Wells Fargo are fantastic info that demonstrate newest real estate loan pricing when you look at the actual-day.

What is an annual percentage rate?

When you look-up latest mortgage loan prices, you might find APR rates close to rate of interest percentages. Brand new Apr or annual percentage rate was inclusive of the pace as well as almost every other costs you are able to spend when you create the borrowed funds.

When have a tendency to mortgage rates increase?

Home loan cost rise based several points. Home loan pricing was in fact upwards of 6% since . This means the earlier you could safe a low interest, the higher.

So what does a large financial company do?

You don’t have to find a very good mortgage state all by oneself. A large financial company deals with the account to help you lock in an excellent higher interest rate and acquire an informed financial on precisely how to get a mortgage from. You might have to pay this individual a 1% payment on the mortgage, nevertheless the benefit of handling a broker is because they will find you the best package and you may work at their actual property agent with the intention that everything you happens smoothly.

Don’t decide on the first rates you see. Make sure to comparison shop to get the best rate of interest on the market.

Your budget ‘s the number you earn prequalified to own regarding bank. You should look at so it count to acquire a stronger insights of how much household you might reasonably (and you may easily) pay money for.

You have made pre-recognized to possess home financing after you get a hold of your ideal family. Possible come back to the bank for the number need, and they’ll sometimes accept your into financing or deny you. We wish to rating pre-accepted showing you to definitely, in case the offer are accepted, you are completely with the capacity of purchasing the house.

Imagine if We have a reduced credit history and you can financial institutions wouldn’t provide in my opinion?

Your credit rating can be to 740 or maybe more getting banking institutions provide a respectable mortgage. Whether your credit rating is just too lowest and you can banks try flipping you away, you will find some actions you can take.

1. Look into an enthusiastic FHA mortgage. FHA fund are especially if you have lowest credit scores. You could potentially get a keen FHA financing if you make yes to analyze the newest caveats in the above list. A keen FHA loan is a good selection for you.

2. Your credit score need not feel reduced permanently! You could raise they. Make an effort to lower financial obligation you commonly thought to be an excellent risk to make your entire charge card repayments after they are due. Cannot has actually a balance on the credit card if you might move it.

Banking institutions select credit card repayments once the a try work with for your mortgage. The greater amount of responsible you are together with your charge card, the greater responsible you’ll end up with your home loan. (Banking institutions state this. We realize just how responsible you are currently.)

Set-up a keen autopay element for those who just forget to pay out-of your cards, but be mindful of it. Sometimes, autopay takes one to complete period when deciding to take feeling when you begin it, and you you certainly will run into almost every other unforeseen technical difficulties.

So what does Bristol loans they mean if someone co-cues the loan mortgage with me?

When you have difficulties bringing financing, you could have somebody co-sign the mortgage to you. Your co-signer takes full obligations throughout the loan when the you don’t pay. This new co-signer is actually on the name of the home.

Manage mortgage loans keeps desire?

Sure, you’ll have to spend interest on your mortgage. You’ll want to secure a minimal rate you could potentially.

What are current home loan cost?

There are many different useful websites that will let you know exactly what newest home mortgage cost is. Internet sites such as Bankrate and Wells Fargo are fantastic info that demonstrate newest real estate loan pricing when you look at the actual-day.

What is an annual percentage rate?

When you look-up latest mortgage loan prices, you might find APR rates close to rate of interest percentages. Brand new Apr or annual percentage rate was inclusive of the pace as well as almost every other costs you are able to spend when you create the borrowed funds.

When have a tendency to mortgage rates increase?

Home loan cost rise based several points. Home loan pricing was in fact upwards of 6% since . This means the earlier you could safe a low interest, the higher.

So what does a large financial company do?

You don’t have to find a very good mortgage state all by oneself. A large financial company deals with the account to help you lock in an excellent higher interest rate and acquire an informed financial on precisely how to get a mortgage from. You might have to pay this individual a 1% payment on the mortgage, nevertheless the benefit of handling a broker is because they will find you the best package and you may work at their actual property agent with the intention that everything you happens smoothly.

Don’t decide on the first rates you see. Make sure to comparison shop to get the best rate of interest on the market.